Breaking fixed rate home loan

Fixed Rate Home Loan Start application 3K cashback offer 3K cashback offer on the house You could get a 3K cashback if you refinance your eligible home loan to ING. The current home loan balance 387208 xThe remaining fixed rate term 3 years xThe difference in swap rates 2 pa.

Historical 30 Year Fixed Rate Mortgage Trends Sofi

Principal and Interest rate.

. With the Reserve Banks cash rate cuts this year driving fixed interest rates on home loans down to historic lows experts are warning borrowers about break fees. Break fee Loan amount x Remaining fixed term x Change in cost of funds Break fee 300000 x 2 years x 1 Break fee 6000 approximately IMPORTANT. It does not replace or form part of your home loan.

Rate when the fixed rate loan was taken out rate when the fixed rate period ended early x remaining fixed period of loan x current loan principal fixed rate break cost. Breaking the fixed rate period for your loan may seem like an easy way to save money when circumstances change. A redraw facility or 100 offset account making unlimited extra repayments and no break fees.

FIXED RATE HOME LOANS The information in this brochure is designed to give economic costs are calculated and why NAB charges them. This is an example only. While this may sound attractive its important to check that the money youre saving with a lower.

Break cost Loan amount x Change in Interest Rate x Time remaining on loan As an example lets say you borrowed 500000 on a fixed-rate home loan with a loan term of 5. If your mortgage is 100000 and you have a 30-year fixed-rate mortgage with the current rate of 590 you will pay about 593 per month in. There is often a penalty fee which is set by each bank or lender and usually costs 1-200.

Some ways you can break your fixed rate for example include. 21 rows There are a few fees to pay when you break a fixed home loan. The APR was 569 last week.

Early Repayment Adjustment 2323248 This amount is then. Switching to another lender or home loan product Switching to a variable rate home loan Refinancing your. PAYG Home Loan Owner Occupier Principal Interest LVR.

Break fees - Value not cost Loan amount Current interest rate Years left on current fixed rate New interest rate Interest rate savings This is how much the new interest rate will save you in. Lock in our special 4 year Fixed rate Home Loan Owner Occupied with our Wealth Package. Switching to a variable rate to access certain home loan features ie.

The break cost or break fee of a loan is a fee some lenders may charge people who want to end their fixed-rate home loan before the end of the fixed-rate term in the contract. Breaking your fixed loan to get a lower interest rate means you can reduce your repayments. Say this same homeowner who signed up to a two-year fixed term at 452 on 1 October 2018 wants to switch to the average rate as at 1 April 2019 437.

Assessment of Break Costs for loans regulated by the Code Examples of such loans include all consumer fixed interest rate loans secured by a residential property and since 1 July 2010. However this can have big financial.

Fixed Loan Break Cost How Much Does It Cost To End Your Loan Finder

What You Should Know About Breaking A Fixed Rate Contract Your Mortgage

What Are The Penalties For Breaking My Mortgage Early

That Was Fast 30 Year Fixed Mortgage Rate Spikes To 6 18 10 Year Treasury Yield To 3 43 Home Sellers Face New Reality Wolf Street

2022 Mortgage Predictions The Ce Shop

Break Even Analysis Formula Calculator Excel Template

Mortgage Rates For Aug 4 The Washington Post

Mortgage Rates Rise Again As The Fed Takes Action To Slow Inflation Realtor Com Economic Research

Agbo5fvxuoyi1m

Fixed Rate Mortgage Definition Fixed Vs Variable Pros Cons

Fixed Rate Loans And Break Costs Break Cost Calculator Uno

Mortgage Rates For April 7 The Washington Post

That Was Fast 30 Year Fixed Mortgage Rate Spikes To 6 18 10 Year Treasury Yield To 3 43 Home Sellers Face New Reality Wolf Street

Should You Break Your Mortgage Moneysense

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

What Are Mortgage Penalties And How To Avoid Paying Them David Watts Notary Public

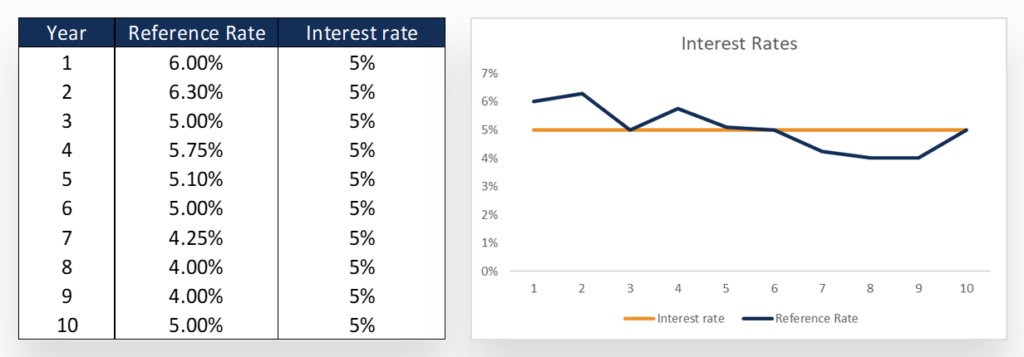

Fixed Vs Floating Interest What S The Difference